International trade involves numerous factors such as payment for imports in the exporter’s country; shipment of goods within the limitations prescribed and difficulties of enforcing legal rights in the foreign country etc. Therefore, to overcome these hurdles, a system has been enforced; this system is represented by ‘Letter of Credit”.

The letter of credit is today the foremost way of financing international trade. In simple words, a letter of credit (L/C) can be defined as:

“A bank’s written undertaking given to the exporter for payment of a certain sum of money on behalf of the importer provided the exporter tenders to the bank, or its overseas agents, the specified documents within a specified period in accordance with the terms of the undertaking”.

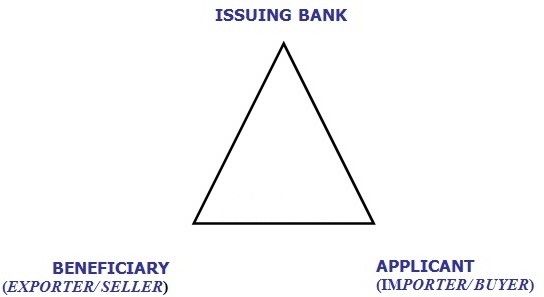

Parties involved in LC

- Importer

- Issuing Bank

- Exporter (Beneficiary)

- Beneficiary’s Bank

Other parties involved in L/C processing will be discussed in subsequent sections.

Letter of Credit Process Flow Chart

1st exporter export the goods

Importer pays after receiving goods

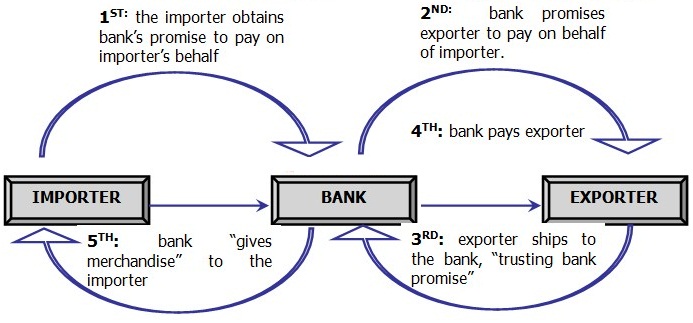

The dilemma of not trusting a stranger in a foreign land is solved by using a bank as an intermediary.

Letter of Credit Application Form

After having an approved L/C limit, the process of L/C opening starts with the L/C Application form. The bank has prescribed a standard application form that contains the required guidelines, instructions, and other relevant terms and conditions under which the L/C is to be opened and claims from the beneficiary are to be settled.

The application form contains the following

Description of the goods, detail of quantity, unit price, total price, and currency of credit.

Instructions about the advice of credit, whether it should be sent by registered mail, by courier or telecommunication.

Form of credit: whether revocable or irrevocable, confirmed or unconfirmed. Due to permission of irrevocable credit only, it is prescribed on form.

The name and address of the beneficiary.

Type of credit: whether sight, Usance, etc.

The validity period of credit and last dates for shipment and negotiation.

Port of shipment and port of destination and whether trans-shipment and/or part-shipment are allowed.

Types and number of sets of documents required to be submitted by the exporter.

Shipping terms in the contract of sale, e.g., FOB, C&F, or CIF, etc.

An application form is a formal contract between the issuing bank and the applicant; therefore, it is signed by the customer, who by doing so undertakes to abide by the terms and conditions of L/C, mentioned in the application form.

Adhesive Stamp

The application form must possess a legal stamp worth Rs.100 or 500. Form without this adhesive stamp is not accepted. This legal stamp is pasted on the application form before giving it to the applicant.

Advantages of Letter of Credit

Since a letter of credit is opened only by the importers with established credit standing, the exporter is sure of receiving the price of his commodity.

An exporter may obtain necessary finance immediately on shipment under a letter of credit (through negotiation, OD Buying).

A letter of credit may help the importer to meet its financial difficulties. He may obtain some finances against the L/C (as FIM, FATR, etc.).

Similarly, an L/C enables the exporter to obtain finances from his bank, for the operations of production even before shipment (e.g. Pre-shipment finance).

Valid city markets have unusual importance regarding import operations and are considered as a business and commercial hubs of imports.

The process of imports starts with the establishment of a letter of credit. Before going into the details of this process, first the explanation of the letter of credit (L/C) and its basic aspects.

Letter of Credit Process

Starting from the establishment of an L/C, till the retirement of documents, the following are the banks involved in the whole L/C Cycle.

Issuing Bank (Opening Bank)

The banker opening the letter of credit is called Opening Bank or Issuing Bank. Opening a bank’s undertaking under an irrevocable or confirming L/C is absolute. Therefore, once an L/C has been communicated to the beneficiary through the bank, the banker has no option, but to pay, provided the other terms and conditions have been fulfilled.

Advising Bank

The bank that advises the L/C means who physically delivers the L/C to the exporter on the behalf of the issuing bank. It is a correspondent bank of the issuing bank situated in the beneficiary’s country or it can also be a branch of issuing bank.

Negotiating Bank

The negotiating bank receives the documents and delivers them to the exporter. When the exporter completes all the documents, after making the shipment, the negotiating bank sends them to the issuing bank.

Reimbursement Bank

According to ICC Rules, Reimbursement against foreign currency has to be made through the country originating that currency. Therefore, for dollar transactions, reimbursement has to be made (received) through the banks situated in the USA.

When issuing banks don’t have any branch in the USA (for dollar payments), like ACBL, the reimbursement is made through a bank in the USA, where the issuing bank has Nostro Account, that bank is known as Reimbursement Bank or Drawee Bank. It is a correspondent bank or issuing bank and makes payment by debiting the Nostro account.

Types of Letter of Credit

Revocable L/C

“A revocable letter of credit may be amended or canceled by the issuing bank at any moment, without prior notice to the beneficiary”.

This form of credit gives the buyer maximum facility but it places the seller in a difficult position when the goods are in transit and the credit is revoked before the documents are presented and payment has not been made on presentation.

Irrevocable L/C

“An irrevocable credit constitutes a definite undertaking of the issuing bank to accept and pay the bills drawn upon it so long as the terms and conditions stipulated in the letter are fulfilled”.

This form of credit can be amended or canceled only with the agreement of all parties to it. Therefore, it gives the seller complete protection.

Confirmed & Unconfirmed L/C’s

A confirmed credit is the one that has been confirmed by the advising bank. By confirming a credit, the bank agrees to take the liability of making payment to the seller if the issuing bank defaults for any reason

“When an issuing bank authorizes or requests another bank to confirm its irrevocable credit and the latter has added its confirmation, such confirmation constitutes a definite undertaking of such bank (the confirming bank), in addition to that of issuing bank, provided the stipulated documents are presented and that the terms and conditions of the credit are complied with.”

Whereas, an unconfirmed credit is one that exclusively depends upon the issuing bank’s obligation.

The parties to the present-day international trade transactions prefer a confirmed irrevocable credit because it is an instrument of the highest quality which ensures the payment to the seller by the advising bank while the buyer is assured of receiving the documents of title to goods, as specified in the terms of credit.

Sight L/C or L/C at sight

If the beneficiary of credit is to obtain payment immediately on presentation of stipulated documents, it is a Sight Credit”

In this form of credit, the exporter draws a sight or demand draft payable at the counters of the advising bank or the bank specified in the letter of credit. The draft (bill of exchange) is paid on a presentation provided that all the other terms of the credit have been complied with.

USANCE L/C:

When a credit stipulates payment to the beneficiary upon the maturity of a bill of exchange drawn under the terms of the credit, it is an ‘acceptance credit’, ‘terms credit’ or Usance Credit”. In this form of credit, the beneficiary draws a draft for a particular Usance (e.g. 30, 60, or 90 days, etc.), payable upon either the correspondent bank or the issuing bank.

Clauses of Letter of Credit

A letter of credit contains several clauses. The main ones are:

Type of Credit

The heading of credit indicates the type of credit and its purpose. For this purpose, every bank has prescribed its own letter of credit forms.

Value of Credit

The fixed amount to which the bank is liable is specially mentioned in the letter of credit.

Specifications of Documents

The documents required are specially mentioned in the credit

Description of Goods

A brief description of goods that are required by the importer is given.

Partial-Shipment and Trans-Shipment

Part-shipment

Shipment of goods in lots or installments i.e. in more than one shipment.

Trans-shipment

Carriage of goods by more than one vessel or mode of transport.

The credit must specify whether this can be trans-shipped / part-shipped or not.

Validity Period

This is a very important clause and because every credit indicates an expiry date or the validity period. This period is so fixed to provide sufficient time to complete the transaction.

Reimbursement Clause

This clause indicates the method for obtaining the reimbursement by the foreign negotiating bank. It will be discussed elaborately in a later part.

Matthew is a Co-Founder at BusinessFinanceArticles.org. Matthew was a floor manager at a local restaurant in Wales. He lost his job after the pandemic and took initiative to make a team and start the project.

ali says

Hi, i am starting to work with new client who is in Uruguay, he place order of cargo pant to me . The situation is that client will open master Lc to my comapny but i will make the goods from factory and i will have to open child Lc to factory after deducting my money on which i got the order.

I need to ask what clause shall i add in master Lc that clarify this.

Editor says

Hi Ali,

Each country has different Laws, We suggest you to check from your Local Freight Forwarder, Custom Clearing Agent and Banks to have smooth trade.