According to the Tax Foundation, nearly 8% of businesses in the United States operate as partnerships, making them one of the most common forms of pass-through business structures. Partnerships are especially popular among professional services, small firms, family businesses, and startups that want flexibility without the complexity of a corporation.

In simple terms, a partnership is a business structure where two or more people agree to share ownership, profits, losses, and management responsibilities. In some cases, an existing sole proprietor may also add another owner and convert the business into a partnership.

What makes partnerships unique in the US is their flexible structure. Partners can have different roles, levels of involvement, profit-sharing ratios, and liabilities—usually governed by a partnership agreement and state partnership laws.

While exact real-time figures fluctuate, partnerships remain a significant part of the U.S. business landscape. According to IRS data, more than 4.5 million partnership tax returns were filed for the 2022 tax year, the majority of which were multi-member Limited Liability Companies (LLCs) taxed as partnerships.

Although LLCs and sole proprietorships now dominate new business formations, partnerships—particularly those structured through LLCs—continue to play a vital role in businesses where profits, risks, and management responsibilities are shared among multiple owners.

This partnership guide explains:

- All types of partners recognized in practice

- Their rights, duties, and liabilities

- How admission and retirement work

- The difference between partnership and co-ownership

- Real-world, US-relevant explanations

Key Characteristics of Partnerships

Before exploring partner types, it’s important to understand a few core features of partnerships in the US:

- Partnerships are pass-through entities for federal tax purposes

- Partners report profits and losses on individual tax returns

- Each partner may act as an agent of the firm

- Liability often depends on the type of partner and the type of partnership

- You can check out the detailed article on Partnership Characteristics here.

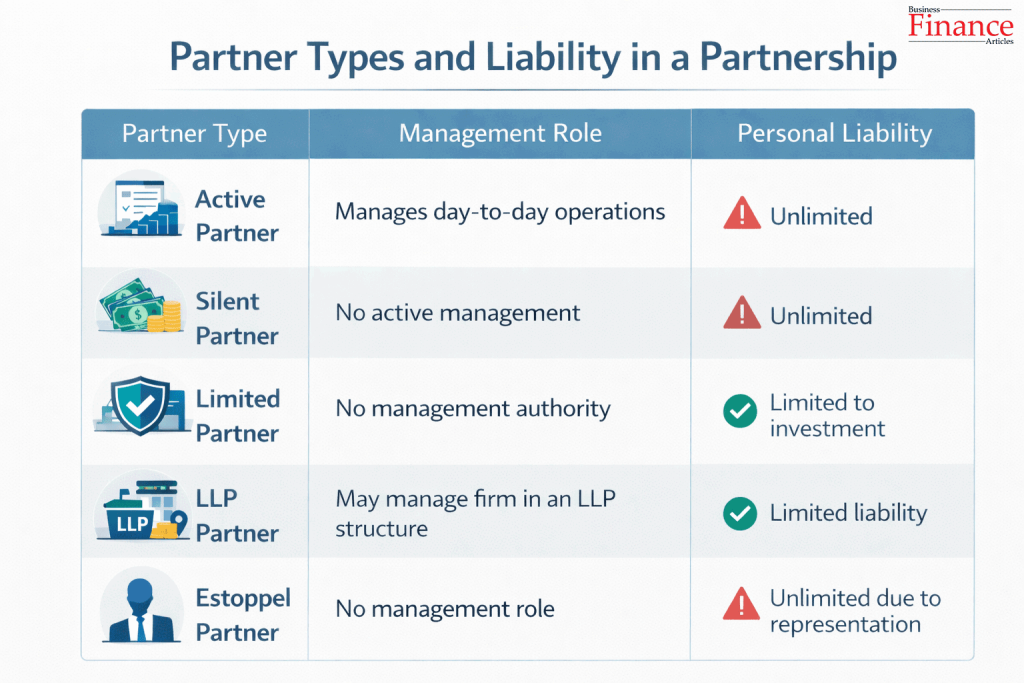

Types of Business Partners in a Partnership

1. Active Partner (Managing or Working Partner)

An active partner takes part in the day-to-day management of the business. They usually contribute capital, labor, expertise, or all three.

Key features of Active Partner:

- Participates in management and decision-making

- Shares profits and losses

- Has unlimited liability in a general partnership

- Can legally bind the firm through business actions

Example: A co-founder who manages operations and client relationships in a consulting firm.

2. Nominal Partner

A nominal partner is a person whose name is used by the firm to gain credibility, but who does not actively participate in the business.

Key features of Nominal Partner

- No real investment or management role

- No share in profits or losses

- Liable to third parties due to name association

- Used mainly for reputation or goodwill

Example: A retired industry expert allowing their name to appear on a law firm’s letterhead.

3. Sub-Partner

A sub-partner shares in the profits of an existing partner, not directly in the partnership firm itself.

The relationship exists only between the main partner and the sub-partner, not with the firm.

Key features of Sub-Partner:

- The firm does not recognize the sub-partner legally

- No right to participate in management or decision-making

- No liability for partnership debts or obligations

- Rights depend entirely on the private agreement with the main partner

Example: An individual privately agrees to receive 20% of one partner’s profit share as a return on funding, without appearing in partnership records.

4. Silent Partner (Known to Public, Not Active)

A silent partner invests capital and is publicly known as a partner but does not participate in daily business operations.

Key features of Inactive Partner

- Contributes money or assets to the firm

- Shares both profits and losses

- Has full personal liability under general partnership rules

- Chooses not to engage in management activities

Example: A local restaurant lists an investor as a partner, but day-to-day decisions are handled by managing partners.

5. Secret Partner (Active but Not Publicly Known)

A secret partner actively participates in the business but is not disclosed to customers, suppliers, or the public.

Key features of Secret Partner

- Invests capital and helps manage operations

- Shares profits and losses like other partners

- Fully liable for firm debts under US partnership law

- Identity remains confidential externally

Example: A silent co-founder helps run operations behind the scenes but is not listed on the website or signage.

6. Sleeping or Dormant Partner

A sleeping (dormant) partner neither manages the business nor is known publicly as a partner.

Key features of Dormant or Sleeping Partner

- Contributes capital only

- No involvement in daily affairs

- Still personally liable for firm debts in a general partnership

- Common in long-term or passive investment arrangements

Example: A retired professional invests in a family business but takes no operational role and avoids public exposure.

7. Minor Partner (Admitted to Benefits Only)

Under US partnership principles, a minor may be admitted to the benefits of a partnership, but not full legal responsibility.

Key features of Underage Partner

- Entitled to share profits only

- Not personally liable for losses or debts

- Has the right to inspect accounts

- Upon reaching majority age, must choose whether to remain a full partner

Legal note:

This is rare in modern US practice and must be handled carefully to avoid liability disputes.

8. Quasi Partner

A quasi partner is a former partner who withdraws from management but leaves capital invested in the firm.

Key features of Quasi Partner

- No role in management or decision-making

- Capital treated similarly to a loan

- Receives interest or profit-linked returns

- Considered a deferred creditor, not an active partner

Example: A retiring founder leaves funds in the business and receives returns without involvement.

9. Senior Partner

A senior partner contributes significant capital, expertise, reputation, or leadership to the firm.

Key features of Senior Partner

- Often receives a larger share of profits

- Exercises greater influence over decisions

- Typically a founding or long-standing partner

- May act as a strategic leader or mentor

Example: A senior attorney in a law firm who built the client base and brand over decades.

10. Junior Partner

A junior partner contributes less capital and holds a more limited role in management.

Key features of Junior Partner

- Smaller profit share

- Less voting or decision-making authority

- Often newer, younger, or less experienced

- Gains exposure and experience over time

Example: A newly promoted associate admitted as a junior partner in a consulting firm.

11. Partner by Holding Out (Estoppel Partner)

A holding-out partner represents themselves as a partner, even though no formal partnership exists.

Key features of Estoppel Partner

- No right to profits

- Can become liable to third parties

- Liability arises if others relied on the representation

- Applies through statements, conduct, or branding

Example: Someone publicly introduces themselves as a firm partner and signs emails as such, leading a vendor to extend credit.

12. Salaried Partner

A salaried partner receives fixed compensation, profit share, or both, without necessarily contributing capital.

Key features of Salaried Partner

- Often involved in management

- Known publicly as a partner

- Receives salary plus incentives or profit share

- Fully liable for firm obligations in general partnerships

Example: A senior manager promoted to “partner” with a guaranteed annual salary.

13. Incoming Partner

An incoming partner is admitted into an existing partnership with the consent of current partners.

Key features of Incoming Partner

- Requires unanimous or agreed consent

- Liable only for acts after joining

- Past liabilities apply only if contractually assumed

- Rights and duties defined in the partnership agreement, here are what to mention in agreement.

Example: A tech startup adds a new equity partner after securing funding.

14. Retired or Outgoing Partner

A retired partner withdraws from the firm but retains responsibility for past obligations.

Key features of Retired Partner

- Liable for debts incurred before retirement

- Free from future liability after proper public notice

- May compete independently

- Cannot use the firm’s name, goodwill, or trademarks

Example: A partner exits a CPA firm and starts a new practice under a different name.

15. Partner in Profits Only

A partner in profits only shares profits internally but not losses.

Important US legal note: Even if losses are excluded internally, the partner may still be liable to third parties unless structured as a limited partnership or LLC.

Example: An investor agrees to receive profit distributions but avoids operational involvement.

16. Limited Partner (Limited Partnership – LP)

A limited partner exists only in a Limited Partnership (LP) formed under state law.

Key features of LP / Limited Partnership

- Liability limited to invested capital

- No management authority

- Protected from business debts

- Common in real estate, private equity, and investment funds

Example: Passive investors funding a commercial real estate project through an LP structure.

LLP vs LP vs General Partnership

- General Partnership: Easiest to start, highest personal risk

- Limited Partnership (LP): Good for investors who want limited risk but no control

- Limited Liability Partnership (LLP): Best for professionals who want protection and management rights

| Feature | General Partnership (GP) | Limited Partnership (LP) | Limited Liability Partnership (LLP) |

| Governing Law | State Partnership Acts (UPA/RUPA) | State LP statutes | State LLP statutes |

| Formation | Automatic (can be informal) | Formal filing required | Formal registration required |

| Owners | All partners | General + Limited partners | All partners |

| Management | All partners manage | Only general partners manage | All partners may manage |

| Liability | Unlimited personal liability | General: unlimited Limited: limited | Limited liability for partners |

| Liability Protection | None | Partial | Strong |

| Tax Treatment | Pass-through | Pass-through | Pass-through |

| Common Use | Small businesses | Real estate, investment funds | Law, accounting, consulting firms |

| Personal Asset Risk | High | Medium | Low |

Admission of a New Partner

A new partner can be admitted if:

- All existing partners consent

- The person is legally competent

- Terms are defined in the partnership agreement

The incoming partner:

- Is liable for future obligations

- Is not liable for past debts unless agreed

Retirement or Withdrawal of a Partner

In the United States, a partner’s right to retire or withdraw depends largely on the type of partnership and the terms of the partnership agreement.

A partner may retire:

- With notice (At-Will Partnerships): In partnerships formed without a fixed duration, a partner can usually withdraw by giving reasonable notice to the other partners.

- With consent (Fixed-Term or Particular Partnerships): If the partnership was formed for a specific time period or purpose, early withdrawal generally requires the consent of the remaining partners. Otherwise, the retiring partner may be liable for damages.

Key Legal and Practical Considerations

- Public notice limits future liability: A retiring partner remains liable to third parties for future obligations until proper public notice of retirement is given. This protects creditors who may otherwise rely on the partner’s continued association.

- Capital settlement follows the partnership agreement: The outgoing partner is entitled to receive their capital contribution, profit share, and accrued interest as defined in the agreement. In the absence of clear terms, state law governs the settlement.

- Competition is allowed—with limits: A retired partner may start a competing business unless restricted by a non-compete clause. However, they cannot:

- Use the firm’s nameExploit trademarks or goodwill

- Misrepresent association with the former firm

Properly managing retirement or withdrawal is essential to avoid ongoing liability, disputes, or reputational damage, making advance planning and legal documentation crucial.

Difference Between Co-Ownership and Partnership

| Basis | Co-Ownership | Partnership |

| Formation | By law | By agreement |

| Profit motive | Not required | Essential |

| Agency | No mutual agency | Each partner is an agent |

| Transfer of interest | Free transfer | Consent required |

| Business existence | Optional | Mandatory |

| Continuity | Unaffected by death | Affected by death/exit |

Why Understanding Partner Types Matters

Understanding the type of partner you are—or plan to become—is critical in the United States, because each partner role carries different legal, financial, and tax consequences under state partnership laws.

Choosing the wrong partner classification can expose individuals to:

- Unexpected personal liability: In general partnerships, partners may be personally responsible for business debts, lawsuits, or contractual obligations—even if they were not directly involved in the decision.

- Tax complications and compliance risks: Different partner roles affect how income, losses, and self-employment taxes are reported to the IRS. Misclassification can lead to incorrect filings, penalties, or audits.

- Legal disputes among partners: Ambiguity around authority, profit sharing, or responsibilities often leads to conflicts, especially when roles are not clearly defined in writing.

- Loss of management control or decision-making power: Some partners may unknowingly give up voting rights or authority while still remaining liable for business actions.

Because of these risks, a well-drafted partnership agreement is essential. It should clearly define:

- Each partner’s role and authority

- Profit and loss distribution

- Capital contributions

- Exit and retirement terms

- Dispute resolution mechanisms

Most importantly, the agreement must comply with state partnership laws (such as the Uniform Partnership Act or its state-specific version), since partnership rules vary across US states.

Conclusion

Partnerships remain a vital and flexible business structure in the United States. Understanding the different types of partners, their roles, and liabilities helps business owners structure firms strategically, reduce risk, and ensure compliance with US law.

For entrepreneurs seeking flexibility, shared expertise, and pass-through taxation, partnerships—when structured correctly—remain a powerful option.

FAQs

❓ Are there different types of partnerships in the US?

The main partnership forms in the US are General Partnerships (GP), Limited Partnerships (LP), and Limited Liability Partnerships (LLP). Each differs in liability, management, and legal protection.

❓ What is the safest partnership type in the US?

A Limited Liability Partnership (LLP) is generally the safest, as it protects partners’ personal assets from business debts and lawsuits related to other partners’ actions.

❓ What is the difference between an LLP and an LP?

In an LLP, all partners can manage the business and have limited liability.

In an LP, only general partners manage, while limited partners are passive investors with limited liability.

❓ Can a partnership exist without a written agreement?

Yes, under US law a general partnership can exist automatically, but operating without a written partnership agreement is highly risky and strongly discouraged.

❓ Do all partners have unlimited liability?

No.

- In General Partnerships, yes

- In LPs, only general partners

- In LLPs, liability is limited for all partners

❓ Which partnership type is best for professionals?

LLPs are most commonly used by:

- Law firms

- CPA firms

- Medical practices

- Consulting firms

Source Reference

- Reference [1]: https://taxfoundation.org/overview-pass-through-businesses-united-states/

Articles published under the BusinessFinanceArticles Web Desk are prepared for publication and edited for clarity, formatting, and site guidelines before going live on BusinessFinanceArticles. Content under this designation does not represent individual authorship.

AvaGoddarda says

What are the Consequences or Effect of Non. Registration of partnership

Admin says

The non-registration results may be.

Disability of firm: Un-registered firm cannot file suit for the recovery of the dues or for other matters against third parties.

Disability to partner: The partner of an unregistered firm cannot bring a suit for the enforcement of a right against a third party or his co-partner unless the firm is registered

Ability against firm and partner: The third party has full right to file a suit of their dues against the un-registered firm and the partners.