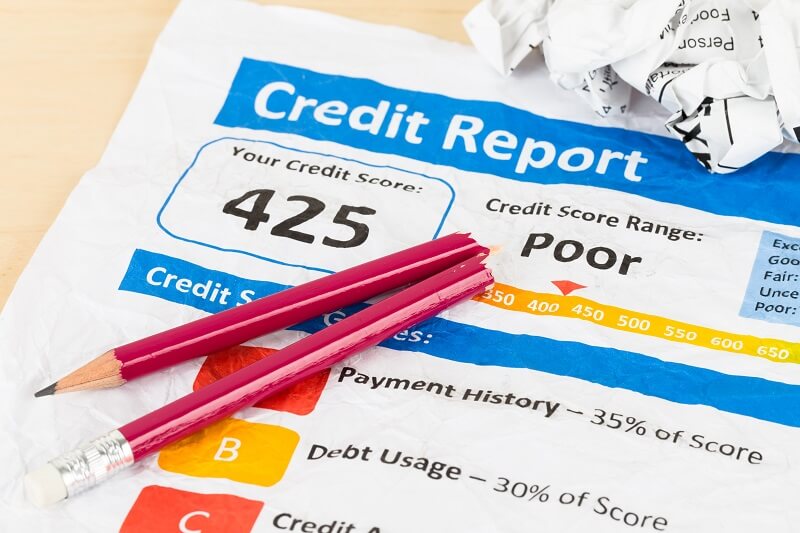

Credit scores reflect the creditworthiness of a borrower. In other words, they can tell whether a person can pay his loans religiously or not. In most cases, a credit score is the basis of a lender’s granting a loan application. The better a credit score is, the higher the chance a person’s application will be approved.

Suppose you’re planning to apply for a loan. In that case, you may need to know more about credit history, such as a bad credit score. For that purpose, here’s an article to guide you in discovering the damaging side effects of a bad credit score. So, read on!

1. Loan Disapproval

A deficient credit score can lead to loan disapproval. Bad credit history may also prompt a lender to thoroughly scrutinize a person’s application, longer than borrowers with average to excellent credit scores. Furthermore, borrowers with lower credit scores may also receive worse proceeds than those with better credit history.

To prevent this, you may need to fix your credit score or press the hard reset button for your financial life. Also, people with bad credit health may opt for personal loans for bad credit if the chances of getting approved are low to zero in traditional lenders.

2. Higher Insurance Premiums

Many lenders often link credit delinquency to bad credit scores. This could mean that people with unpleasant credit histories have a higher chance of overdue payments and dormant accounts. Because of these, they may file claims for their credit insurance. This may repeatedly happen until the person’s insurance score is affected.

Your overall credit record may be tainted when this happens, and your future insurance applications may ask for a higher payment. To fix your credit score and avoid penalties, you may need to take care of the following:

- payment history

- credit history length

- outstanding debt balance

- payment frequency

- credit mix

3. Higher Interest Rates

Spotless credit history will likely give you better loan offers and discounts. On the other hand, a bad credit score may lend you loans with higher interest rates. The longer you can pay, the worse it may be for your financial status. Because of this, you’ll likely suffer from a repeated cycle of loan payments without much recovery.

Higher interest rates resulting from bad credit history don’t just include loan rates but also credit card rates and mortgages. So, it may be advisable to settle first your credit history before attempting any loan application.

4. Fewer Credit Card Options

The better the credit score, the more credit card options for a person. These choices include but are not limited to the number of credit cards as to brand and type. In many cases, lenders may only approve borrowers with credit cards with the highest interest and fewer advantages.

On the other hand, people with excellent credit history may be offered lower interests and many perks, such as travel freebies, reward points, and pay cuts. If you’re planning to apply for a credit card, you may just restore your credit health and work on your debt and loan management at a young age to be credit-worthy.

5. More Challenging Apartment Application

An unhealthy credit score may result in a challenging apartment lease or rental application. Many landlords look for a person’s credit history to determine his capacity to pay. For this purpose, landlords may ask for the receipts of previous payments or credit settlement records.

Often, this is coupled with a set of requirements that shows his source of income and monthly net or take-home pay. If a person has a clean slate in credit, his application could be quicker and may also have a faster rental or lease approval.

6. Higher Number Of Requirements For Loans

Initially, a person having a fresh start in his credit life may only need to sustain his credit score and history to have a fast and high loan removal. The additional requirements could be the debt-to-income ratio that could be analyzed by sifting through the person’s submitted papers, such as salary or wage records.

On the other hand, lenders usually ask people with awful credit scores to submit collateral, such as property or financial securities. These terms are often classified under secured personal loans. Apart from this, lenders may also seek investment accounts and origination fees to process your loan.

7. Unsuccessful Job Applications

Many Human Resource Department professionals typically check a person’s background through his credit history and other essential documents. Many HR pros interpret payment gaps and delays to reflect one’s character. Because of this, people with horrible credit scores may have challenging job applications.

8. Difficulty In Starting A Business

Starting a business can be complicated as applying for a business loan, and business credit cards are likely rejected if one has a bad credit record. Any financial transaction concerning the business may also experience different difficulties and slow progress.

Because of this, you either prepare your funds in your startup to have enough budget to support your business initially or fix your credit score early. You may also ask other startup owners with credit scores like yours to have more ideas about what to do.

9. Slow Career Growth

Whether you’re after a promotion or a higher-paying reassignment, you need reliable credit health to show that you’re financially responsible. If your credit score is bad, the chance of you getting promoted could be slimmer. Until such a time that your credit history is restored, you’ll always have slow career growth.

Wrapping Up

A bad credit score has many side effects that can affect a person’s entire life. Whether this person has an active credit life or not, a bad credit score can dwindle the chances of promotion, loan approval, and better business opportunities. To prevent this from happening, maintaining a good credit score is vital.

Suppose you’re planning to purchase a property or buy a luxury item through credit. In that case, you may need to weigh down your options properly. In addition, you need to monitor your credit score regularly if you’ve reached the limits for your expenses. Seeking the help of a financial consultant could also improve your purchasing decisions and your entire life.

Hi! This is Ifama. I am a student and giving my services in SEO. I have a lot of experience in digital marketing. Travelling is my hobby and I love visiting different hilly areas and doing adventures.

Leave a Reply